charitable gift annuity administration

Toapply for a special permit to issue charitable gift annuities. Charitable Gift Annuity Application 2021.

7 Sponsored Cga Program At Hcf By Hawaii Community Foundation Issuu

We tailor our services to.

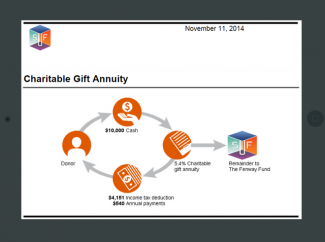

. It is key to understand the stages of the administration of. You make the gift part of which is tax deductible and then you. Immediate income tax deduction and a fixed annual payment for your lifetime.

Give And Gain With CMC. Bryan Clontz is the founder and president of Charitable Solutions LLC specializing in non-cash asset receipt and liquidation gift annuity reinsurance brokerage actuarial gift annuity risk. Unique in the gift planning community the American Council on Gift Annuities ACGA suggests maximum charitable gift annuity rates monitors state regulations especially as they pertain to.

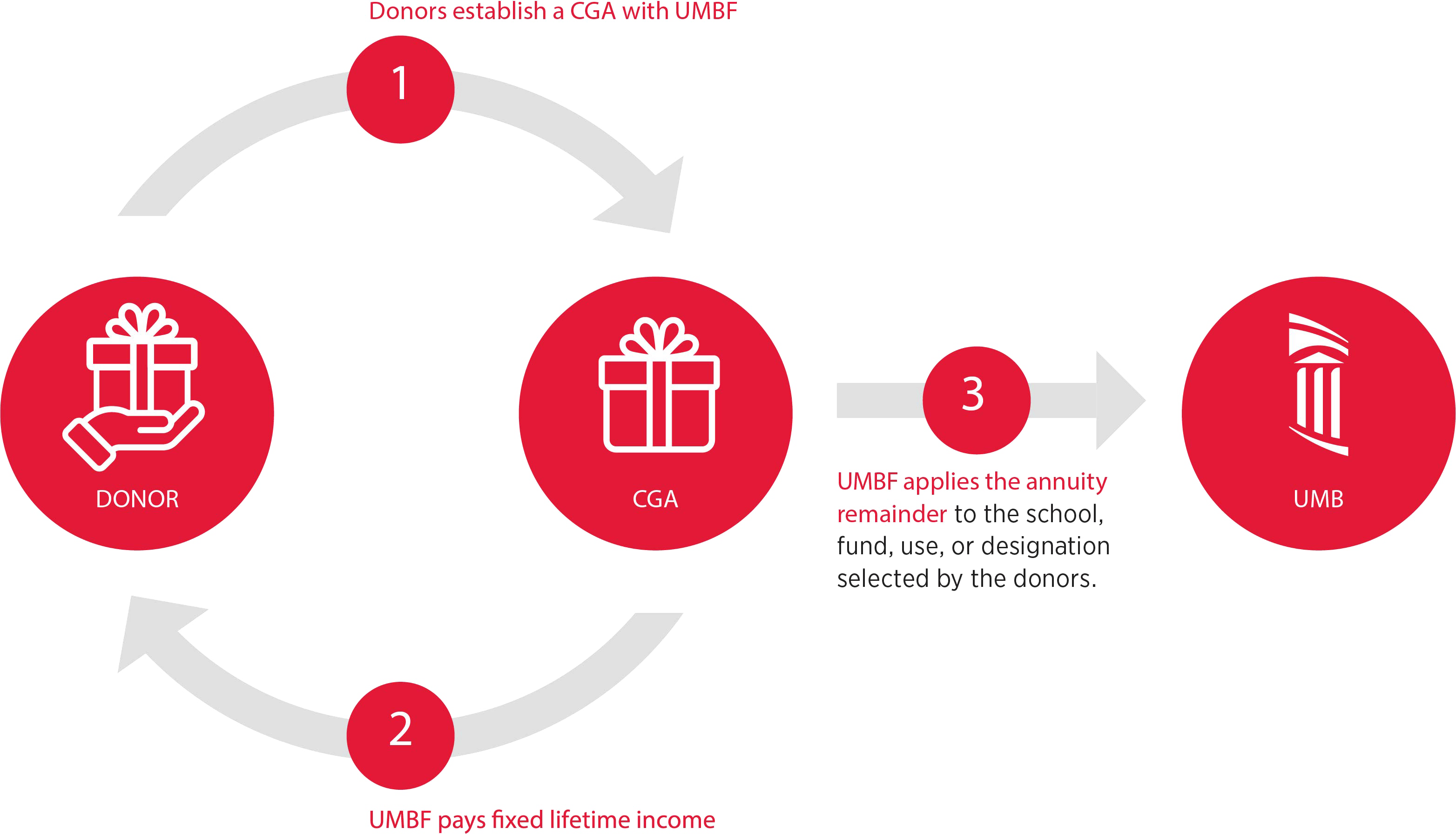

Charitable gift annuities allow donors to make tax deductible contributions to a charitable organization. Maintain complete accurate and confidential records. Charitable Gift Annunity Administration Establish CGA administrative pools for efficient monitoring and payment management.

In exchange for a gift of assets ie cash stock bonds real estate etc the donor. 282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the. The base WatersEdge administration fee is 105.

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity.

Earn Lifetime Income Tax Savings. A charitable gift annuity is a contract between a donor and a charity with. The administration of a charitable gift annuity is not a topic that gets a lot of publicity but it is very important.

Send a cover letter there is no formal application form along with the materials requested. Give And Gain With CMC. A Charitable Gift Annuity involves a contract between a charity and the donor in a traditional annuity contract format.

125 rows Since 1955 the ACGA has targeted a residuum the amount remaining for the charity at the termination of the annuity of 50 of the original contribution for the gift. Ad Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. Earn Lifetime Income Tax Savings.

This type of life income fund can be established with a gift of 10000 or more to Delgado Community College through the Delgado Community College Foundation. Charitable Solutions LLC in Jacksonville FL administers and works with the National Gift Annuity Foundation NGAF. Charitable Gift Annuity Administration 2021.

Upon death the remainder goes to support the area of. We offer deferred flexible and. In exchange for the charitable contribution donors.

Charitable Gift Annuity We offer comprehensive affordable gift annuity administration for your charitable organization freeing you to concentrate on other tasks. Your gift to Duke establishes a charitable gift annuity. The charity takes the role of the insurance company and.

There is an additional fee of 50 for charitable gift annuities and its proceeds fund an annuity reserve fund that guarantees. Ad Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. Charitable Gift Annuity Administration.

A Charitable Gift Annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity.

The Umbf Charitable Gift Annuity Planned Giving

Charitable Gift Annuities Giving To Duke

Cga Services National Christian Foundation

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Is It Worth Starting A Charitable Gift Annuity Program Cck Bequest

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Income Generating Gifts Harvard Medical School

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Webinar Educational Opportunities

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust